Future-Proofing Payment Management for Next-Generation Networks

As the telecom industry moves towards 5G, the ultimate IT end goal must focus on flexibility.

With the advent of 5G and digital transformation, an architectural shift away from monolithic applications and towards a more microservices-based approach is becoming more common. At the same time, the risk of business support continuity issues is dramatically reduced. This is significant across the entire CSP revenue management process, including traditional billing and rating but also in actual revenue collection and payment processing.

In the past, payment processing was typically an embedded process that was intrinsically linked to the CSP BSS infrastructure. That model today is simply too rigid and requires a new approach that separates the actual payment processing function to reduce risk, increase operational performance and lower costs. As revenue collection is the number one priority for any operator, a new flexible approach embraces an architecture that brings flexibility and function together. Let’s take a look at some of the critical business needs and objectives of a next-generation modern payment management system:

- Process payments at any time, even if other complementary systems are down;

- Help reduce PCI footprint, which helps simplify any audit process, improves security and makes any regulatory changes easier to manage;

- Innovate based on market condition without a hard dependency for an expensive billing system upgrade;

- Support multiple billing systems and multiple channels, enabling easier access to merchants, partners, customer payment preferences and payment mechanisms;

- Increase efficiency in merchant management, which enables lower processing fees;

- Scale based on service demand spikes, driven by a service promotion period, an innovative new offering, or even just a simple PPV offering, all of which generates payment transactions;

- Reduce operating expenses.

Creating a Modern Payment Management System

5G and next-generation services and business models are already impacting the CSP business roadmap, driving a greater need for cloud-native, elastic and open source platforms that do not stymie service creativity at a time when competitive pressure from non-traditional market entrants can dramatically shift a market by simply entering it. Similarly, take one look at Netflix, Disney or any other OTT provider as a disrupter to the cable MSO landscape and the relevance of agility in any transformation should be front and center.

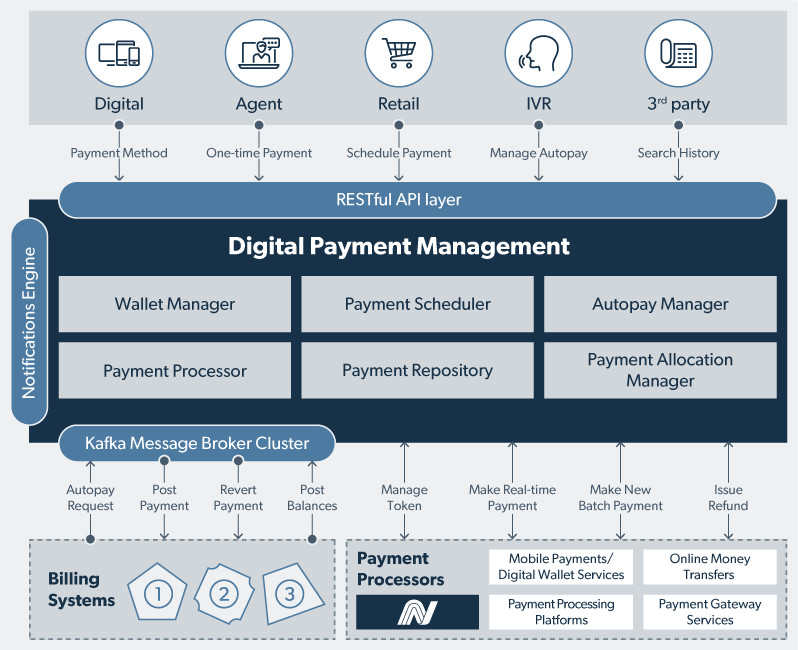

For the CSP, digital payment platforms can actually help act as a driver of industry transformation itself and become a distinct point of flexibility in the entire revenue management process by helping eliminate existing bottlenecks with existing silos. The ideal scenario is where open source payment management becomes a dedicated platform that links traditional BSS with the customer, the partner and the payment processors themselves, as seen in Figure 1 below.

Figure 1: Integrated Digital Payment Management Architecture

Source: Netcracker Technology

This architectural approach for payment management quite simply puts service flexibility and business continuity at the forefront, and for Netcracker, is one of the founding principles of our revenue management strategy. Netcracker’s Payment Management and Processing capabilities, available today in Netcracker 12, are cloud native, microservices based, embrace open source technologies like Cassandra and Kafka, and are a core component of our revenue management solution for the industry. This architecture creates an ideal scenario where open source payment management becomes a dedicated platform that links traditional and oftentimes disparate BSS with the customer, the partner and the payment processors themselves.

For a CSP with multiple billing systems, the payment management engine directly interfaces with each, enabling everything from convergent balance management to auto payment. This eliminates disparate payment silos, synchronizes the process, helps converge the customer management process and improves the customer experience. Different contact channels can be directly integrated using RESTful APIs, again allowing for a consolidated payment structure, unifying the payment data management process so payment histories, schedules or methods can be easily tracked and measured. Lastly, a single point of integration with payment processors helps reduce cost and creates consistency of processes across whatever preferred payment processor a customer wishes to use.

For CSPs, there’s nothing worse than downtime or disruption of services, and shifting the payment processing system to a centralized platform approach that can link existing systems together, consolidates and orchestrate data and facilitate new business should be a no brainer. With economic and competitive pressures coming from all sides, guaranteeing faster time to both existing and new revenue should be a no brainer as well.